What will cause the economy to recover?

"Tuesday October 29, [1929] was the most devastating day in the history of the New York stock market, and perhaps the most devastating day in the history of markets. It combined all the bad features of all the bad days before. Volume was immensely greater than on Black Thursday (10-24-29), the drop in prices was almost as great as on Monday. Uncertainty and alarm were as great as on either.

"Tuesday October 29, [1929] was the most devastating day in the history of the New York stock market, and perhaps the most devastating day in the history of markets. It combined all the bad features of all the bad days before. Volume was immensely greater than on Black Thursday (10-24-29), the drop in prices was almost as great as on Monday. Uncertainty and alarm were as great as on either.

Selling began as soon as the market opened and in huge volume....at the first hour sales were at a 33,000,000-a-day-rate."

J. K. Galbraith, "Things Become More Serious," The Great Crash 1929.

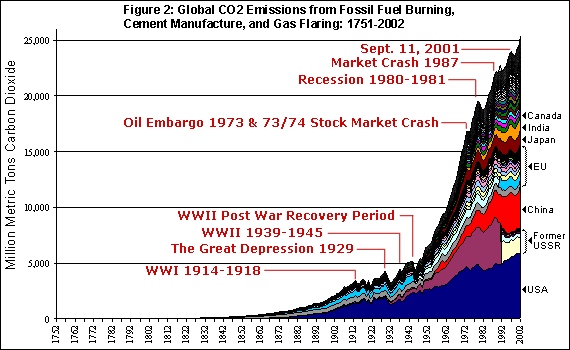

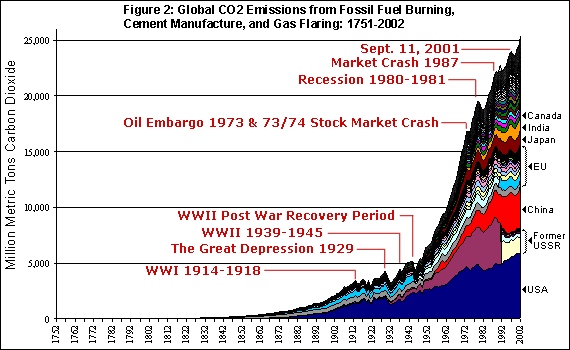

The list of periodic commercial capital spasms.

Today despite the 2008 collapse of markets that may be worse than in 1929-1939, many more people are invested in the stock market than in 1929 and the mortgage swaps as investment vehicles are spread so far --yet so poorly tracked-- around the world.

In addition this is the first US depression and panic that comes during, instead of after a war.

The situation is compounded by the fact we had more educated leadership in the Thirties than we do now.

Banks are larger now and have international breadth with respect to loans and commercial impacts in addition to having been less regulated since the repeal of the Glass-Steagall Act in the 1999. Thus the wall between commercial and investment banking is all but nonexistent.

The hedge fund market is not regulated, making it hard to track investments.

Short of Keynesian economic spending, meaning investments in distributive energy, efficiency, and diversification of the fuel supply, there is little to get this depressed market revived again.

What happened with the melt-down of the markets in 2008?

“government sponsored enterprises” or GSEs

"the 2008 housing meltdown that impoverished millions."

". . . . it remains true that the GSEs were the major purchasers and packagers of securities based on mortgages, and they acted with the implicit guarantee that the bonds they sold were backed by the federal government. When the meltdown occurred, that guarantee went from implicit to explicit, and the federal government moved in and backed all of those toxic obligations. It also fueled the conservative attack that two key executives of Fannie Mae, the larger of the two agencies, were also influential players within the earlier Clinton administration and had led the fight to prevent any meaningful regulation of those mortgage-based securities."

"The tale of their [GSEs] alliance with leaders of a runaway mortgage industry, particularly the industry-dominant figure of Countrywide’s Angelo Mozilo, who also cofounded subprime sinkhole IndyMac Bank, which failed as well, is central to the debacle that ensued. But to mention the guys on the quasi-government–sponsored side and not their key partners in the fully privatized mortgage business is to deny reality."

Keep up with Robert Scheer’s latest columns, interviews, tour dates and more at www.truthdig.com/robert_scheer.

A reveiwer says:

" . . . the finance industry, their lobbyists and allies among leading politicians destroyed an American regulatory system that had been functioning effectively since the era of the New Deal."

Robert Scheer’s book, The Great American Stickup: How Reagan Republicans and Clinton Democrats Enriched Wall Street While Mugging Main Street.

What was Glass–Steagall?

This act separated investment and commercial banking activities. At the time, "improper banking activity", or what was considered overzealous commercial bank involvement in stock market investment, was deemed the main culprit of the financial crash. According to that reasoning, commercial banks took on excessive risk with depositors' money.

Senator Carter Glass, a former Treasury secretary and the founder of the U.S. Federal Reserve System, was the primary force behind the GSA. Henry Bascom Steagall was a House of Representatives member and chairman of the House Banking and Currency Committee. Steagall agreed to support the act with Glass after an amendment was added permitting bank deposit insurance.

The Great Crash 1929, quoted in The Essential Galbraith, p. 293.

recessions

depressions

past catastrophes

Volatility of petrol

comparative costs

market problems

energy markets

periodic commercial contractions

"Tuesday October 29, [1929] was the most devastating day in the history of the New York stock market, and perhaps the most devastating day in the history of markets. It combined all the bad features of all the bad days before. Volume was immensely greater than on Black Thursday (10-24-29), the drop in prices was almost as great as on Monday. Uncertainty and alarm were as great as on either.

"Tuesday October 29, [1929] was the most devastating day in the history of the New York stock market, and perhaps the most devastating day in the history of markets. It combined all the bad features of all the bad days before. Volume was immensely greater than on Black Thursday (10-24-29), the drop in prices was almost as great as on Monday. Uncertainty and alarm were as great as on either.