Reification

"the market"

"the market" Navigating the site:

How defining the term "markets" poses an analytical problem for understanding resource use:

Adam Smith is often used incorrectly; but when unaccounted for assets are costing commercial expenses that buyers and sellers in these markets are not paying, the costs are shared by outsiders to these financial transactions.

As Alan Sloan, business editor of Newsweek and NBR contributor writes:

"Adam Smith, the avatar of free markets, talked about market participants acting in their own self-interest. But they often don't—they grab what they can today without regard to the long term. Self-interest—which takes the long term into account—is good. Greed—gobbling everything you can get today, and the devil take the hindmost—is a sin.

Andersen's a classic example: Some partners acted out of greed, and destroyed the entire enterprise. Some mutual fund companies acted the same way: They put the entire enterprise at risk to make a few extra bucks of fees by allowing hot-money hedge funds to "time" their funds. Translated into English, that means they skimmed profits at the expense of the funds' other investors.

Andersen's a classic example: Some partners acted out of greed, and destroyed the entire enterprise. Some mutual fund companies acted the same way: They put the entire enterprise at risk to make a few extra bucks of fees by allowing hot-money hedge funds to "time" their funds. Translated into English, that means they skimmed profits at the expense of the funds' other investors.

In an idealized world, no one would be so greedy and stupid. In the real world, they are."

Market failures

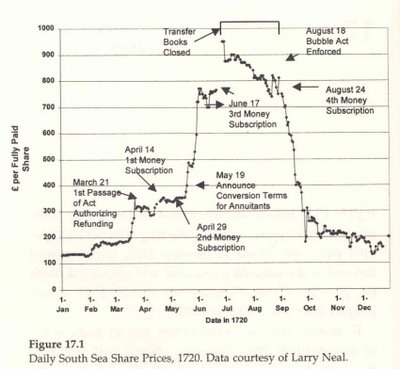

This behavior so well described by Alan Sloan is related to the important concept of market failure, which is where the rational expectation of a well educated public with fully informed buyers and willing sellers, does not come into being to create an equilibrium with respect to prices.

Herman Daly, economist, writes, "Somewhat analogous to the tendency of the market to erode its own competitive foundations is the corrosive effect of individualistic self-interest on the continuing moral context of the community. However much driven by self-interest. the market still depends absolutely on a community that shares such values as honesty, freedom, initiative, thrift, and other virtues whose authority will not long withstand the reduction to the level of personal tastes that is explicit in the positivistic-individualistic philosophy.

p. 50.

And he suggests that "The first two problems of market societies just discussed have to do with the market's tendency to destroy its own necessary social context. The third problem is the more technical one of market failure, proper, and it receives much more attention from economists than do the first two....the market still cannot effectively deal with externalities and public goods."

p. 51.

Herman E. Daly and John B. Cobb Jr., For the Common Good. Boston: Beacon Press, 1994.

Undermining confidence

Now for those who insist on market solutions for allocating scarce resources or restricted access to popular, needed, or other wise indispensable services their inability to understand when, how and where markets fail to promote the optimal use of a resource or service undermines the public confidence in institutional safeguards and often leads to a destruction of the soil, water table, oil field, or other allegedly private property (such as mortgage lending businesses) in resource extraction and conveyance.

This tendency to attribute powers to the collective action of people in terms of markets is an example of reification, that is the tendency of intelligent thinkers to treat something intangible as a concrete reality.

JVS, 8-26-07

Truisms

Greed is the opposite of thrift.

Long-term good can be promoted by self-interest, but not always.

And long-term is the opposite of short-term.

Irrationality in economic decision-making is inherently human.

Knowledge is always restricted by access and may be further intrinsically circumscribed by physical and biological conditions.

.gif)